At a glance

Timeline

Role

1.5 months

Interaction Design, Speculative Design, Ideation, Legal Analysis, Prototyping, Pitching, Entrepreneur

Problem

I started this project after helping my neighbour's wife, who was unaware of their financial details after her husband's death. I discovered that in India, with a population of 1.5 billion, obtaining the financial information of a deceased loved one can be difficult unless there is a written record or a will. Currently >70% Indians don't have a will and aren't prepared for the inevitable.

Goal

To conceive and design an app that facilitates an easy and prompt way to write legal wills and share essential information with those who matter the most and then build a product website.

Output

Mockup - Prototype - Discovery Website

Turn up the volume

A prototype of the Afterlife app.

Why Afterlife?

The sudden passing of my neighbour's husband during the pandemic left their family in disarray, stressing the importance of planning for the unexpected. His wife, unaccustomed to managing finances, found herself overwhelmed and clueless about their financial affairs. Accessing a deceased person's financial information is no easy feat. Witnessing her struggle brought me to the realization that there's no easy way to access a deceased person's financial information, exacerbating an already challenging situation. It underscored the need for an App that facilitates will creation, encourages transparent financial discussions and equips families to handle future uncertainties confidently.

Research

I began researching the feasibility of establishing an online will in India and understanding the laws that govern banking, wills, and inheritance. I also investigated to examine the gravity of the problem.

The markers of a good will:

- A signed, witnessed will is best.

- Best to list all assets in detail with information including the name, unique identification, date of purchase, their current location, current value, etc.

- Clarify in quantity or percentage which asset you wish to bequeath to whom with their full names as per their govt. IDs and your relationship to them.

- To increase reliance, get it witnessed by two independent witnesses who are not your beneficiaries.

The Law:

Any individual over the age of 18 years who is mentally competent has the legal right to prepare this document for the distribution of assets and possessions as per the law. Wills in India are legal documents and have no such strict requirement of a set format. Writing a will can even be done on plain paper without registration or even a handwritten document can be termed as a will.

Section 63 of the Indian Succession Act of 1925 outlines the essentials for a valid will in India.

-

The will must begin by stating that the testator is of sound mind and must name the executor to carry out their instructions. Any previous wills and codicils must be cancelled if this is not the first will.

-

The testator must create a list of all their assets, including property, savings accounts, term deposits, and mutual funds.

-

The will must specify in writing who will receive which assets, including a custodian for minors.

-

The will must be signed in the presence of two witnesses who must attest to the execution by signing it. The date, full names, and addresses of the witnesses must be included in the will.

-

Every page of the will must be signed by the testator and the witnesses.

-

Any amendments to the will must be countersigned by the testator and the witnesses.

-

The original will must be stored in a safe place, and copies must be stored separately if any are produced.

In addition to the previous necessities, there are other essentials for a valid will in India.

-

The testator must sign or append their signature to the will.

-

The will must be witnessed by at least two people.

-

The witnesses must have seen the testator's signature or mark on the will.

-

The witnesses cannot be beneficiaries of the will.

Thus, it is possible to make legal wills online and a well-designed digital will can eliminate any room for doubt that can and eliminate the inherent limitations of written will, for example, questions on authenticity, use of coercion, room for modification etc.

In conclusion,

Digital wills are legal and better.

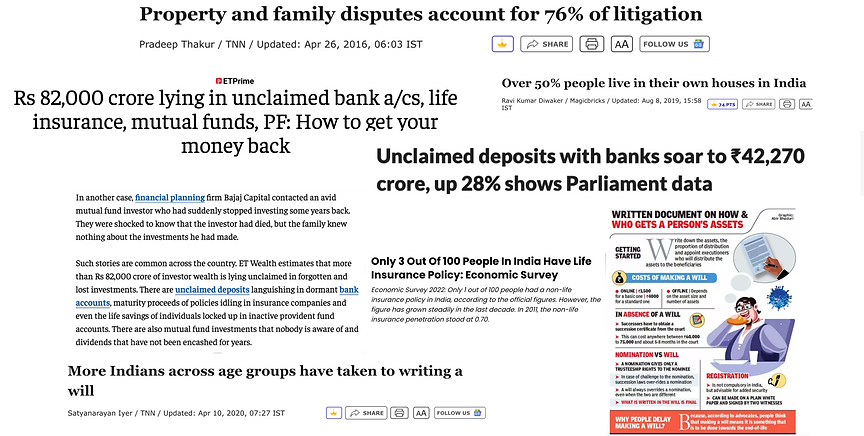

Investigating the problem:

To understand the gravity of the problem I shared the story on Reddit through a post. My post reached the top on the biggest subreddit in India receiving over 100 responses that underlined the gravitas of the problem.

.png)

What are people using currently?

Excel Files

Some people maintain an excel document with details of all assets and share it with their family to them updated. However Excel files aren't secure or easy to create and maintain.

Piece of Paper

It is ridicuous that meany people write important information on paper or in a red diary and then hide it away in a box or locker, hoping for a rare chance that their loved ones will someday come across it.

WhatsApp Chat

Some people reported they share asset details and policies on a group chats with family which seems inefficient since it would be difficult to view, update and keep record.

I also came to realise that over 400 Billion INR remain unclaimed with banks and the issue is so grave that the finance minister discussed it in the parliament.

.png)

Issues faced in the absence of a will:

Not having a valid will leave the family of the deceased vulnerable to unwanted legal exposure in the form of conflicts in division of assets between the family members.

There is a high risk of poaching the assets of the deceased by distant relatives or creditors.

Very often the total assets of the deceased are not known to the family members, who in turn are unable to use them after his death.

About Me

There is a risk of identity theft in the case of social media presence of the deceased in case no one has been appointed for the management of the same.

Conducting Discussions:

During the pandemic, I volunteered to teach a group of elderly women how to safely operate their bank accounts, conduct Zoom meetings, stay safe from online scams, and stay connected with people remotely. I conducted a focus group discussion with them to discuss their involvement in family finances and the importance of writing a will.

Out of 42 women (between ages 44 - 67), only 6 were financially independent. Only 11 claimed to know the details of assets and investments made by their spouse, and only 4 claimed to know the details of bank accounts, assets, and investments of their children. This discussion left me with a sinking feeling in my heart as most women felt too embarrassed to even talk about how little they were involved in the financial decision-making process in their households. Out of 42 women, 28 said they feel hesitant to initiate an open conversation with their family regarding the distribution of assets, with 3 women refraining from answering the question.

In India, it is common for women to be married to men who are older than them. Most women who are above 40 years of age were not afforded the education or opportunities as men to become financially independent. These women have been conditioned to believe that they should not involve themselves in matters of business and finance. Additionally, women tend to live longer than men, which means that these women are likely to face similar circumstances as my neighbour in the last years of their lives unless they are actively equipped with the necessary skills and resources.

Underlining requirements:

Add and manage all beneficiaries

Add kids, partner, siblings, parents etc anyone as a beneficiary regardless of whether they use the app or not.

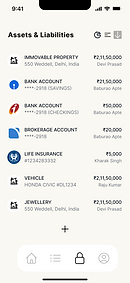

Add Assets & Liabilities

Link your bank accounts, brokerage accounts and loans, add physical assets such as jewelery, land etc, and manage how they should get split up.

Facilitate life and family planning

Based on your background, family and risk level to suggest steps you can take towards life and household finacial planning.

Share personalized memories

Leave notes, voice messages, pictures or videos for your loved ones as part of your will to say the things you never found time or place to share.

Assign legal guardianship

Assign legal guardianship for your kids. Leave personal notes, images and videos for your loved ones as part of your will.

Assign and manage witnesses and executors

Get signatures from witnesses, assign (or choose us) as executors through the app without sharing intricate details of your Will.

Prototype

Understanding user persons:

.png)

.png)

.png)

Website & Feedback:

I launched the product website for Afterlife and received overwhelming feedback with over 350 sign-ups in the first week of launch and even secured an interview with YC! YC pointed out that even the life insurance penetration in India is substantially low, as Indians are generally not proactive about managing their life risks. Therefore, the idea of paying a subscription to keep their will updated may not appeal to everyone.

Reflections

While analysing the market viability and assisting potential customers in drafting and writing wills, I realized that most people in India do not write wills due to a lack of financial literacy and misinformation. At the same time, they struggle with finding ways to communicate essential financial information with their loved ones. There is a need to develop a platform that not only facilitates will creation but also serves as a secure medium that serves to mitigate the bureaucratic hassles and elevate financial literacy.

_edited.jpg)